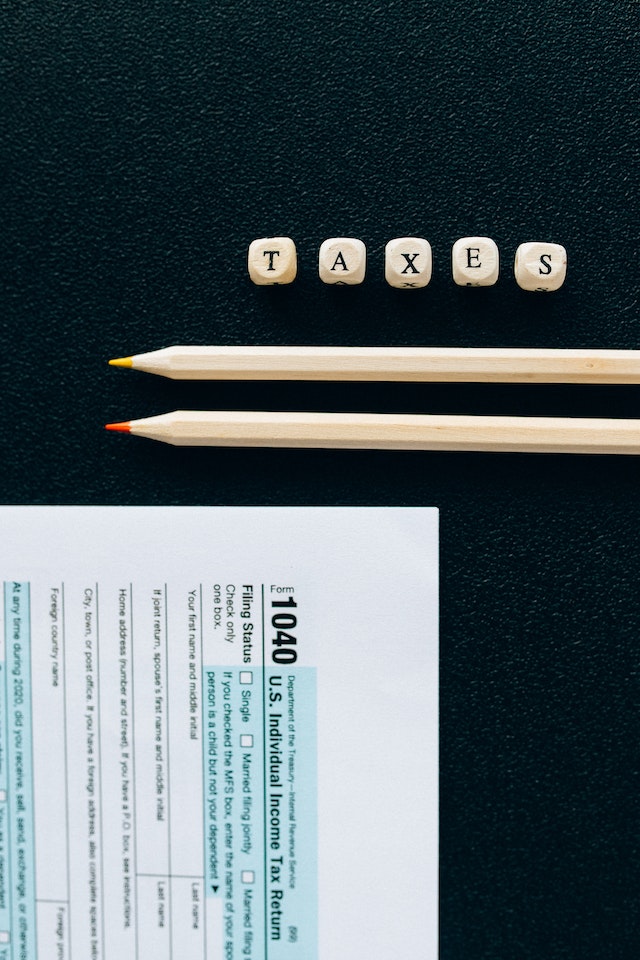

Tax Prep

It’s that time of year, time for tax prep! The IRS started accepting 2023 tax returns on January 29, 2024. I’m not an accountant, only a layperson who likes to submit my information in a timely manner! Situations are different – working or not? Self employed or not? In the spirit of keeping things as […]