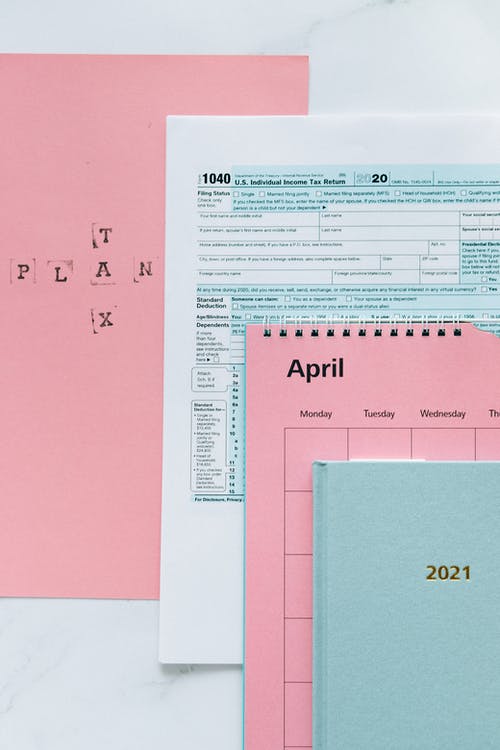

Heads up! If you missed it, there is a new 1099 IRS Rule for PayPal, Venmo and CashApp transactions starting in tax year 2022. This rule impacts small businesses and self-employed people.

Reading an article covering this information in Entrepreneur.com this week, I was reminded how important it is to stay alert and start documenting all transactions for tax year 2022. https://www.entrepreneur.com/article/418771

Business Payments

PayPal, Venmo and CashApp will be required to issue 1099’s reporting to the IRS total payments received by a business account in excess of $600 annually. Until now, the IRS only required a payment app to report when an account received more than $20,000 and had 200 or more transactions within the year.

Small businesses, including an individual with a side hustle, will be required to report its income received regardless of whether a 1099-K was issued from a payment app. As Entrepreneur.com reports, this is something that companies large and small have dealt with for years from payment apps and credit-card processors.

However, very small businesses that are now subject to the new rule may not have their own internal tax departments or a CPA who prepares their taxes to help them wade through numerous income issues and questions that arise when receiving a 1099-K. Where it gets “tricky” if both a 1099 and a 1099-NEC are issued for the same payment, thus “doubling” the income reported by the small business or individual.

Personal Payments

Because PayPal and Venmo have both business and personal accounts, separating business and personal transactions for recordkeeping is critical for all! Despite the two-account option, it’s going to be very common for business owners to receive personal payments in their business accounts, and those amounts will get included on their 1099-K to the IRS.

Tips for following the new Venmo/Paypal rules

Small businesses who will begin receiving 1099s under the new rules should keep in mind the following three key tips to avoid overreporting of income on their taxes.

- Separate your business and personal account payment apps. Small-business owners and self-employed persons should use a separate business account for their business activities. They should only use that payment account for business income and expenses, and it should be tied to their separate business-checking account. They need to be careful not to receive personal reimbursements and funds into their business- payment account, as those amounts received will end up on their 1099-K that’s reported to the IRS. Track expenses and reimbursement amounts. Keep good records of your business expenses and amounts you are paid that are reimbursements of costs you covered for your customer. These amounts are used to reduce the gross income reported to the IRS via a 1099-K, but you’ve got to keep good records and need to track these items in order to deduct them.

- Don’t double count income on 1099s. There will be numerous instances where a self-employed person who provides services to a business customer will receive a 1099-K from the payment app and they will also receive a 1099-NEC from the same customer for the same payment. Self-employed persons and small businesses using payment apps need to ensure that they do not count these amounts twice on their tax return and need to track their business income carefully so that they don’t get taxed twice on the same income. Don’t just rely on the 1099s themselves to track your income. They can result in overpayment of taxes as the payment app has to report the payment, and so does a business customer who is paying the small business or freelancer.

Shields-up Reminder

The situation in Ukraine is solemn. Cyber activity and hacking is prevalent as I type this.

A reminder for those who missed my recent blog about Shields-up. Make sure you/you organizations are up to speed with the latest guidance from CISA (Cyber & Infrastructure Security Agency). Learn more here: https://www.cisa.gov/uscert/shields-technical-guidance

Details, Details, Details

Helping businesses and people with tending to the details is something I love to do. Think about it, details matter at home and work. It’s easy to overlook things (think forest through the trees) 😉

Having a second set of eyes can make life easier while you’re living and for others after you’re gone. Reach out anytime by email: Lynn@thelivingplanner.com and/or check out all my online offerings, resources, and information focused on People, Pets and Business! Online Courses Home Page is: https://bit.ly/LPCourses

Details Matter –Lynn

#CareForPeopleCareForBusiness