When we complete a task we have set forward to complete, there can be a feeling of satisfaction, of completeness such as “yes, that’s done”! We move on from that task onto the next task after placing a “check-mark” on the list of things to do. If we think of filing tax returns, this feeling of satisfaction can last only as long as we begin once again to record our income, expenses and changes for the next filing period.

Life planning is similar, in so much as many of the strategies we use to record and document tools we use to protect us while we are living and protect our loved ones when we are gone require periodic reviews to ensure the changes in life are properly updated and documented.

When was the last time you reviewed your contact information and beneficiaries named for all accounts (retirement accounts, banks, policies you hold, will/trust documents, property, etc.)?

Why is this important? If you have moved; transferred accounts; had a change in marital status, jobs, policies or purchased/sold assets, your accounts will follow the instructions you had formalized before the change. When the changes are significant, the impact could be lead to unintended consequences for loved ones should something happen to you.

A periodic review of your important documents is a process recommended for all of us. Organization of your information allows you to conduct a review for yourself and with your loved ones easily.

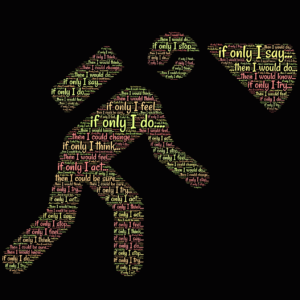

In lieu of the “once and done” philosophy, how about adopting a “done and review” process regularly? As we prepare our taxes, could this be added to your preparation at home and for your business?

In keeping up with indicators / metrics at work, we adjust to meet market demands to remain relevant for clients. This process can be expanded to include working on the business as well as in the business by reviewing all plans, policies and accounts. At home, the same process can apply. By asking “what am I doing to ensure we are protected?” might include reviewing accounts, policies, investments, legal documents to check out they are as we intended.

The Benjamin Franklin axiom that “an ounce of prevention is worth a pound of cure” is as true today as it was when Franklin made the quote!

When you are ready for assistance to ensure you, your family members, employees and company are ready for anything life hands them, we are ready for you. Advanced planning at home and work serves people in measurable and profound ways.

The Living Planner supports proactive resources and quality one-on-one comprehensive individual/family and business planning. Here’s to smooth days ahead!

Contact us to learn more about how we work with individuals, business owners and employees via Email or online @ The Living Planner