Were you aware that despite the pandemic, 2 out of 3 adults do not have a will? Ok, I know I’m focused on care, comfort and protection for all of us in life. Let’s think about this. This statistic from Caring.Com’s 2021 Estate Planning and Wills Survey shocked me this week. https://www.caring.com/caregivers/estate-planning/wills-survey

There is good news. Almost 30% of Young Adults in 2021 have a will! The shocking news is that their 28.6% is 4% more than middle aged adults.

Why is this? It is of interest to dig into this survey a little deeper. Reasons Why People Don’t Have a Will include:

- 34.2% Say “I haven’t gotten around to it”

- 28.1% Say “I don’t have enough assets to leave to anyone”

- 7.6% Say “I don’t know how to get a will or living trust”

- 5.6% Say “It’s too expensive to set up”

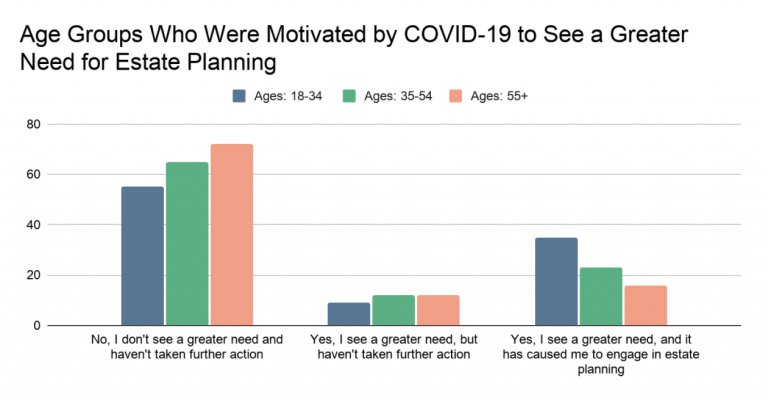

Of those surveyed, 1 in 3 indicated that they saw a greater need for a will due to Covid, but 31% of those who saw the greater need actually took action.

We’re all crunched for time. “I haven’t gotten around to it” is real for so many. It’s the “I don’t have enough assets to leave to anyone” that I’d like to explore a bit further.

I think we’re conditioned to consider our personal mortality, when we hear the words “will”, “trust” or “estate plan”. The “leave to anyone” is the clue here. If that’s the case, we’re missing half the reason why it’s important to have a will, trust and/or an estate plan. The other half is about us, when we’re living. These documents are for us while we’re living to help the normal stuff continue, if something derails us for a time.

This isn’t always fun to think about either. Yet, Covid has taught us all lessons about what’s important, about time and about how sometimes things happen fast.

Privacy and legal issues are in place to protect us. Without us giving permission or authorization in writing via the documents used when creating a will, trust and/or estate plan, others are not able to do anything for us. No paying our bills, no talking with the doctors, no taking care of children or pets. These important life issues are ours to think about and detail out the plan in writing, according to the laws of the state you live in to protect you.

So now, back to the “assets” part. If you have a bank account, a place to live, credit cards, people you care about and bills to pay, you have assets that deserve attention. The attention that only those pesky legal documents (will, trust, estate plan) can give us.

If you don’t know where or how to get started, that’s where I come in. Let’s talk in real language and determine what you need for your unique circumstances. Knowing what we want and taking action in advance of needing to helps smooth the way when it’s time to put our plan into action.

The Living Planner is here to help you understand what’s at risk, what you gain and how to approach this with realism, humor and compassion. For additional information about how I work, check out my website: https://thelivingplanner.com or Email me: Lynn@thelivingplanner.com.

Stay well –Lynn

#CareForPeople #StepInStepUp #LifeHacks