How familiar are you with the term estate tax? Did you know that there can be both federal and state or inheritance estate tax in the US? Let’s look at what it means and how you may plan accordingly.

The IRS defines estate tax as “the estate tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have interests in at the date of your death.”

To total up what you own, add up the fair market value of your cash, securities, real estate, insurance, trusts, annuities, business entities and other assets. This is known as your “Gross Estate”. If deductions are allowed (i.e. mortgages, debts, estate admin costs, property to surviving spouses +), subtract them and then you’ll have your “Taxable Estate” amount.

Image by Gerd Altmann from Pixabay

Federal Estate Tax

Federal Estate Tax is paid on the “Taxable Amount” of the estate. Effective January 1, 2023, the federal gift/estate tax exemption increased to $12,929,000. If your Taxable Amount is less than $12,929,000, you own nothing in federal estate tax. If it is more, tax rates range from 18% – 40%.

State Estate Tax

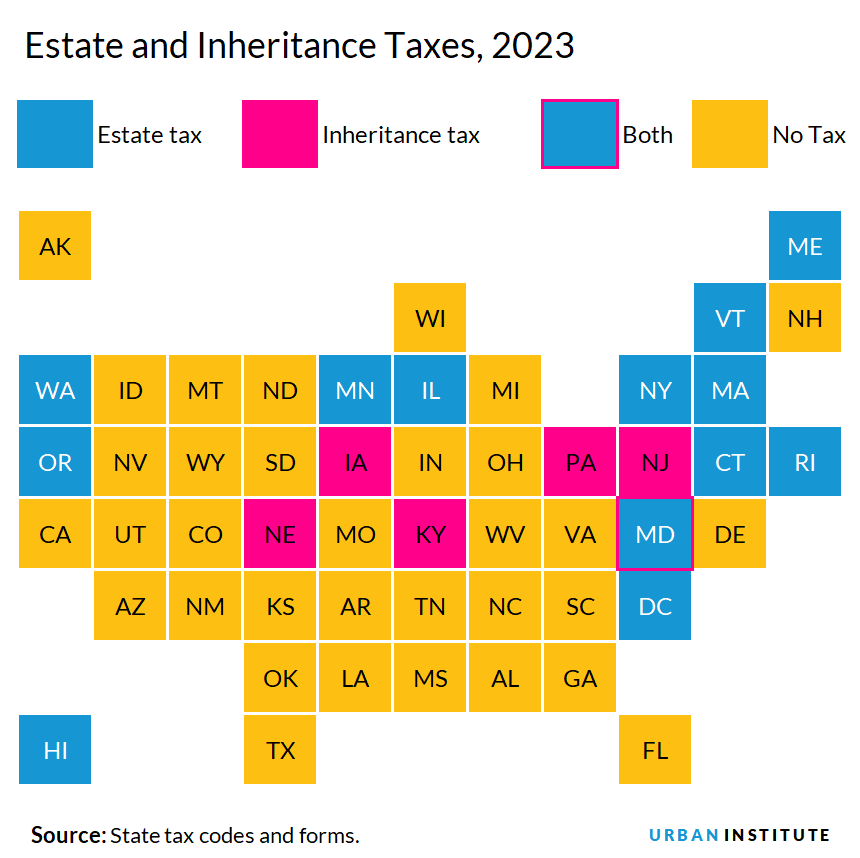

An estate tax is paid by the estate after someone dies in certain states. An inheritance tax is paid by the heirs of the deceased. In 2023, 12 states and the District of Columbia levy an estate tax and six states levy an inheritance. Maryland levies both.

Per the Urban Institute urban.org, New Jersey and Delaware both repealed their estate taxes in 2018. New Jersey still maintains its inheritance tax, though. Iowa passed legislation in 2021 that will phase out the state’s inheritance tax until it is fully repealed in 2025. Most other states without an estate tax eliminated their tax soon after changes were made to the federal estate tax in 2001 (see the section on federal changes below).

Like the federal estate tax, all states that tax estates offer an exemption that excludes most estates from taxation. The lowest state exemptions in tax year 2022 were $1 million in Oregon and Massachusetts. The highest exemptions were in Connecticut ($9.1 million), New York ($6.11 million), Maine ($6.01 million), Hawaii ($5.49 million) and Maryland and Vermont (both $5 million).

Source: State tax codes and forms (Urban Institute)

The Tax Foundation article dated June 8, 2023 about state tax reform and relief continuing in 2023. If you’d like to read more here is the link: https://taxfoundation.org/state-tax-reform-relief-2023/

Gift Tax Exclusion

Did you know there is a gift tax exclusion too?! This is an amount you can give each year to one person without being taxed! FYI, the gift exclusion limit in 2023 is $17,000 to each donee, the donor is generally responsible for paying the gift tax. For more information about the gift tax, visit the IRS.

Your Planning

It’s always a good time to begin thinking about the laws, taxes, and impact to those who will inherit what you’ve built. While we never know what we don’t know – this is something you can control!

Securing good resources throughout all stages of life is a good practice. Happy to share resources when you’re looking to get your ducks in a row! Send me an Email: Lynn@thelivingplanner.com or if you’d prefer to schedule a Complimentary Discovery Call to discuss your particulars, go for it! My main website is: https://thelivingplanner.com.

Summer is here! Carole Carlton has a terrific summer solstice quote, “The summer solstice is a time for strength and vitality for action and movement.” Time for action!❣️Lynn

LifeHacks #CareForPeopleCareForBusiness