The Inflation Reduction Act Bill passed by the Senate and the House this week includes Healthcare Cost Savings measures to be aware of. This bill contains provisions impacting health care, climate and tax reform.

The Inflation Reduction Act is estimated to spend about $485 billion over 10 years on health and alternative energy programs while raising about $790 billion through tax revenue and savings. The difference would be used to help reduce the deficit. Corporations with at least $1 billion in net income (or profit) will be required to pay a 15% corporate minimum tax based on the earnings they report to shareholders on financial statements.

Healthcare Cost Savings

U.S. healthcare spending grew 9.7 percent in 2020, reaching $4.1 trillion or $12,530 per person. Anticipated healthcare cost savings from this bill come from three main areas per CNET.com and KHN.org.

1. Allow Medicare to negotiate prescription drug prices

To address the cost of prescription drugs, the bill would let Medicare annually negotiate prices with pharmaceutical companies on 10 pricey medications, starting in 2026. Fifteen more high-cost and high-use drugs would be added the following year, another 15 in 2028, and 20 more drugs would make the list in 2029. The $740 billion bill includes $288 billion for prescription drug pricing reform for the more than 63 million seniors and others who use Medicare.

Another healthcare cost savings is for Americans enrolled in Medicare. This bill includes a $2,000 cap on out-of-pocket drug costs, which would begin in 2025. According to KFF, 1.5 million Medicare beneficiaries paid more than $2,000 for their drugs in 2019. According to an analysis by the Council for Informed Drug Spending Analysis based on data from 2012, about 3.5 million beneficiaries would likely save more than $1,500 a year.

2. Cap annual drug costs for Medicare Part D enrollees

In addition to negotiated drug prices, healthcare savings in the bill would cap out-of-pocket prescription drug costs at $2,000, starting in 2025, for those with Medicare Part D drug plans. It also adds an option to break that cap into monthly payments. The negotiations would apply first to drugs people get at the pharmacy, but in the later two years, drugs that people get in doctors’ offices could also be covered.

Some of the Medicare changes would kick in next year. One is the cap on price hikes. Under the bill, companies that raise the price of drugs sold to Medicare faster than inflation must pay rebates back to Medicare, generating an estimated $101 billion in savings for the government. The inflation protections will also apply to certain drugs, such as biologicals, that patients get in a doctor’s office. And, the bill would also cover vaccines and sets a $35 cap on insulin for Medicare recipients, starting in 2023!

3. Subsidize health insurance bought on the Affordable Care Act marketplace

Notably, the bill enhances and extends subsidies to private health insurance bought through the public marketplace that were introduced in 2020 under the American Rescue Plan Act. This healthcare savings impacts millions of Americans without company insurance before they are eligible for Medicare. These subsidies would have expired in 2022 and will now be extended through 2025.

Before 2020, the assistance was generally available only to households with income from 100% to 400% of the poverty level. Now that income cap will be (temporarily) lifted, no one will pay a premium that’s more than 8.5% of their income. In 2022, nearly 13 million of the 14.5 million Americans buying health care on the marketplace were receiving subsidies, saving an average of $800 a year, according to the White House.

In the 33 states that use HealthCare.gov, the federal insurance exchange site, premiums would be 53% higher on average this year if not for the extra ARPA subsidies, according to the Kaiser Family Foundation. The same would be true in states operating their own exchanges, the foundation said.

What Impacts You and Your Planning?

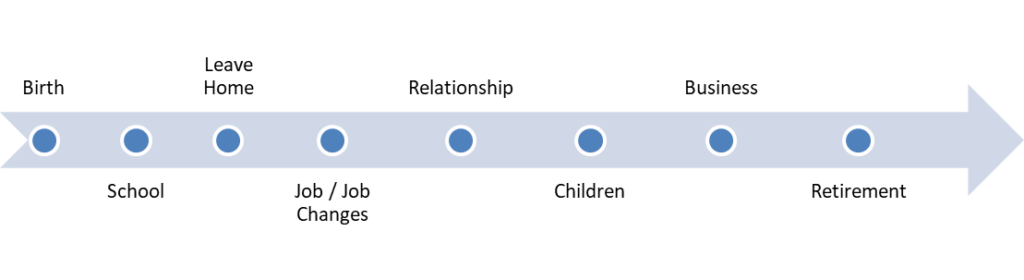

I’m often asked what impacts planning for now and the future. Over the years it becomes more clear that there are things within our control and things outside our control. The trick is how to navigate between the two 🙂

No matter what age we are, there are some basics to cover.

- Stuff at and around home and office

- Finances and financial planning

- Insurance protection

- Health and healthcare

- Legal protective documents

- Just in case plans

- Communication

For those who don’t know me, contingency planning is my thing! When it’s time for you to focus on practical and actionable steps you can take now while you are living, and/or have questions, pop me a note: Lynn@thelivingplanner.com.

If you’d like general information about what I do and why I do it, my website is: https://thelivingplanner.com and my online courses/resources will give you an idea of what I offer to assist people, pets and businesses on this website: https://courses.thelivingplanner.com

To buy the 2022 edition of my book, The Living Planner (What to Prepare Now While You are Living) here is the link: https://www.e-junkie.com/i/u8ac

Taylor Swift says it so well, “Just because you made a good plan, doesn’t mean that’s what’s gonna happen.” Here’s to being ready as best you can –Lynn

LifeHacks #CareForPeopleCareForBusiness